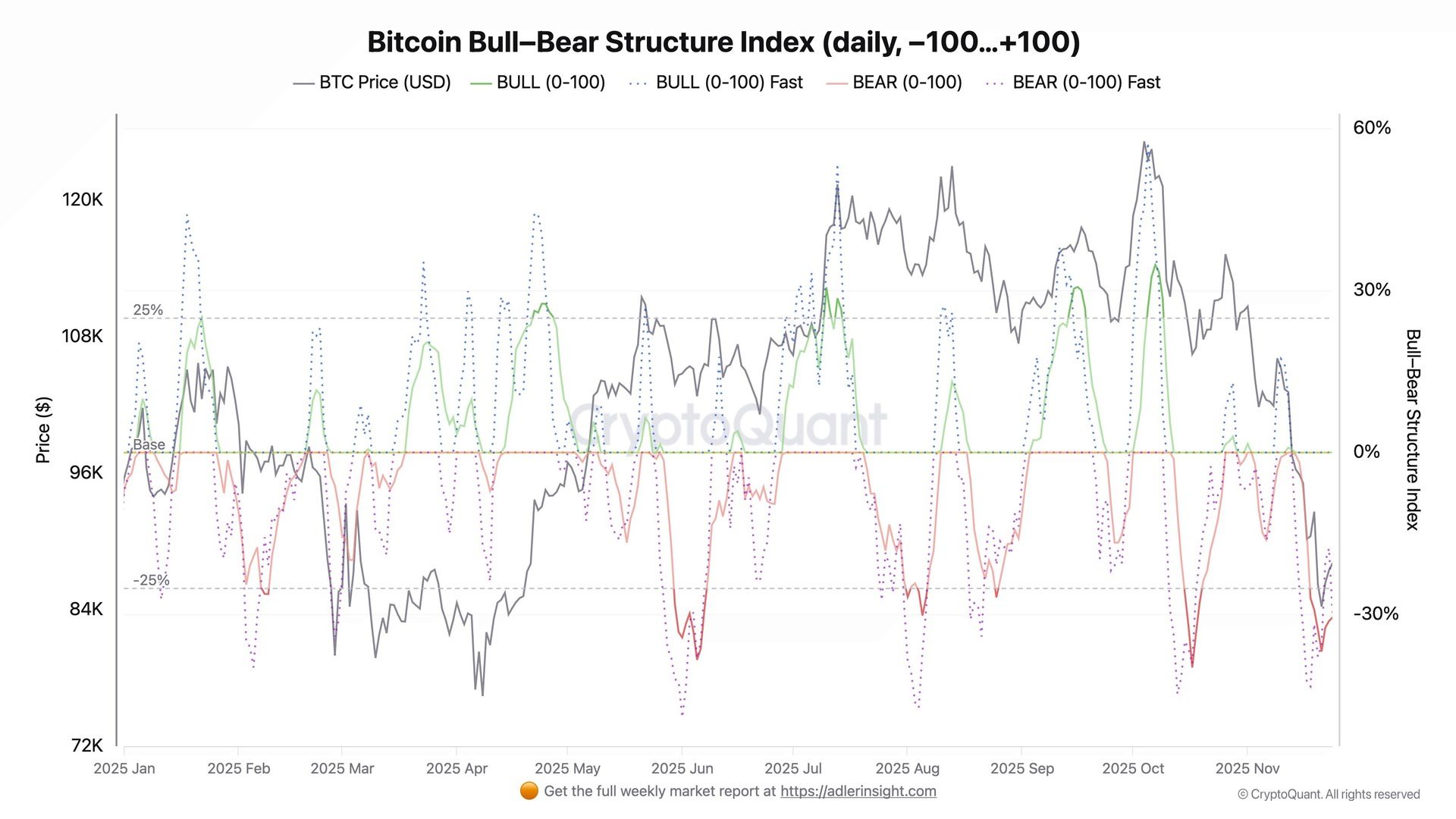

Bitcoin has pulled back from its all-time high near $126,000 earlier in 2025, entering a corrective phase amid profit-taking and macroeconomic caution. As we close out the year, the price is consolidating in the mid-$80,000s, showing signs of stabilization but remaining under pressure from key technical levels.

Daily Chart Breakdown

Support/Resistance: Immediate support around $85,000–$86,000 (recent lows), with stronger defense at $80,000–$82,000. Overhead resistance starts at $89,500–$90,000 (near short-term MAs), extending to $93,000–$94,000.

Trendlines: Short-term downtrend with lower highs since early December. A potential rising support from the $80,000+ low could hold if buyers defend it.

Moving Averages: Price below key SMAs (20-day ~$89,500, 50-day ~$93,600, 200-day higher). Bearish alignment persists.

Momentum Indicators: RSI neutral (~45–50), approaching oversold on dips. MACD shows mild bullish divergence on recent bounces, hinting at short-term relief.

Weekly Chart Breakdown

Support/Resistance: Broader support at $80,000–$84,000, with yearly lows near $74,000 as ultimate backstop. Resistance at $93,000–$97,000, then the prior ATH zone around $126,000.

Trendlines: In a corrective downtrend channel since the peak. Weekly closes below $85,000 would confirm deeper weakness.

Moving Averages: Well below longer-term MAs, with downward slopes reinforcing caution.

Momentum Indicators: Weekly RSI dipping toward oversold (~30–35), often a precursor to bounces in bull markets. MACD remains bearish but flattening.

Trading Signal: Hold

Justification

The dominant trend remains bearish on higher timeframes, with price trapped below critical moving averages and resistances. Short-term daily signals suggest possible oversold bounces, supported by ETF inflows and consolidation patterns, but lack confirmation for a sustained reversal.

Risk a break below $80,000–$82,000 for accelerated downside toward $74,000. Upside requires a decisive close above $90,000–$93,000 to shift momentum bullish. In this ranging, volatile environment, patience is key—avoid forcing trades amid year-end low liquidity.

Stay tuned for updates as we head into 2026. Institutional adoption and macro factors could fuel the next leg higher if supports hold.

Disclaimer: This is not financial advice. Crypto markets are highly volatile